Australian residents are automatically covered for many hospital-related costs under the Government’s Medicare scheme, however many Australians prefer to take out additional cover to give them access to be treated in the private health care system.

Many Australians prefer the option of becoming private hospital patients as they may have more control in choosing their doctor and may be able to reduce their waiting time for elective surgery by choosing to be treated in a private hospital.

Private health insurance can also cover a range of other health cover options for some or all of the costs of the services not covered by Medicare, such as dental, optical items, physiotherapy, prescription pharmaceuticals (non-PBS) and a wide range of other services.

An example to illustrate the differences...

You're skiing in Australia and have a nasty fall, badly injuring the ligaments in your knee. Ski patrol help you back to the ski resort's medical centre where the medical staff patch you up, but to properly fix your knee you're going to need a knee reconstruction.

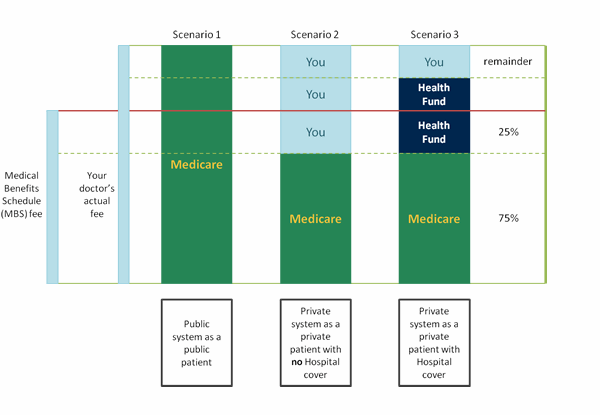

Scenario 1 - The public health system will fix you up for free, but you may have to wait some time before your operation, unless it is seen as critical.

Scenario 2 - If you have no private hospital cover you can elect to have your operation sooner in the private system, but while Medicare will pay for 75% of the Medicare Benefits Schedule (MBS) fee for your medical costs, anything over that plus all hospital costs are payable by you. This could add up to thousands of dollars.

Scenario 3 - GMHBA's Hospital covers help to protect you from those costs by covering all of your hospital costs and some or all of the medical costs not covered by Medicare (except if the service is excluded from that cover).